VAT for Advocates

24 May 2022, Advocates, Barristers

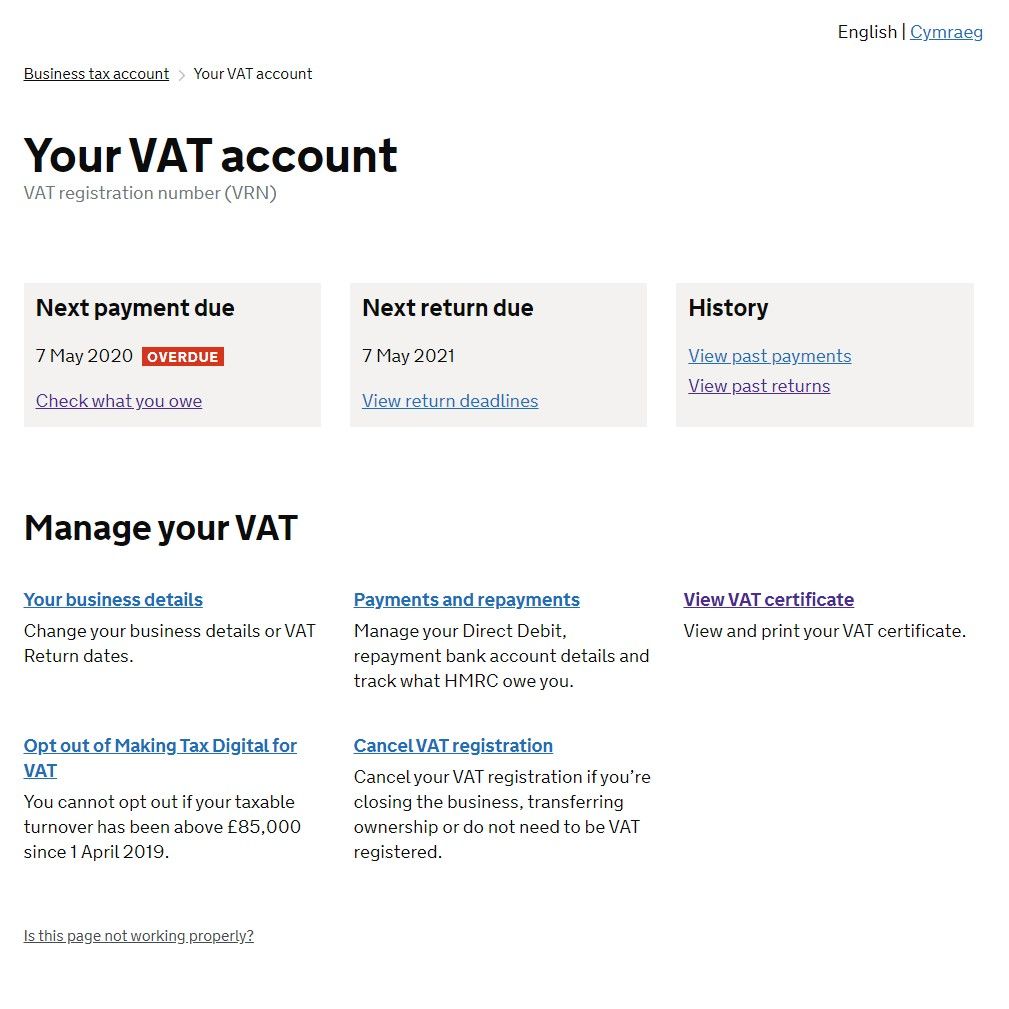

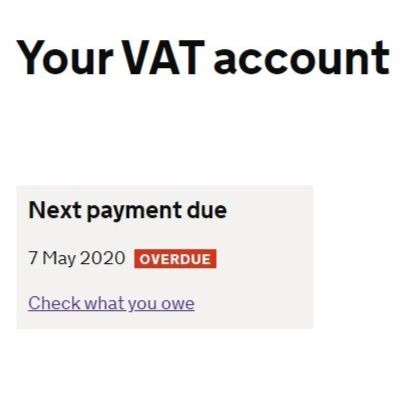

There is specific guidance from HMRC on accounting for VAT for advocates. VAT notice 700/44 was updated on 20th May 2022. The change was only to update a contact address, but with an increase in people leaving work it is a good time to consider the VAT implications of leaving your practice as an advocate. […]