Employment Allowance increase to £5,000

6 April 2022, Companies, Creative Industries, Employer

The employment allowance enables most employers to claim a £5,000 deduction against National Insurance Contributions.

Smarter accounting

6 April 2022, Companies, Creative Industries, Employer

The employment allowance enables most employers to claim a £5,000 deduction against National Insurance Contributions.

24 March 2022, Advocates, Artists, Barristers, Companies, Creative Industries, Employer, Musicians, Sole Traders

The Spring Statement 2022 confirmed increases to National Insurance from the tax year starting 6th April 2022. The threshold for paying National Insurance increases to £12,570 from July, but this doesn’t affect the additional tax on dividends. The difference in the payment date of your dividends by just one day could mean that you pay […]

24 March 2022, Advocates, Artists, Barristers, Companies, Creative Industries, Employer, General, Musicians, Sole Traders

The Spring Statement 2022 confirmed increases to tax and National Insurance from 6th April 2022. The (mild) good news is that the threshold for paying National Insurance increases to £12,570 from July 2022. There are still opportunities for most taxpayers to take advantage of a tax break in the form of pension contributions. What is […]

10 January 2022, Advocates, Barristers, Creative Industries, Musicians, Sole Traders

Don’t forget to pay your personal tax turn by the end of January. Who has to file a personal tax return? If you are self-employed or you are director of a limited company, you need to register with HMRC for self assessment tax returns in most cases. You need to pay your personal tax by […]

28 December 2021, Advocates, Barristers, Companies, Creative Industries, Employer, General, Sole Traders

Alterledger is a learning organisation. Our clients choose us for the insight that we provide. The value we bring is that business owners don’t need to divert their attention to accounts and filing deadlines. Alterledger exists to allow our clients to get with what they do best – their business. Comparison of training and learning […]

26 November 2021, Companies, Creative Industries, General

After an increase of 1.25% in the Finance (No. 2) Bill can we expect a further increase in the tax on dividend income? MPs call for possible increased tax on dividends The following MPs have proposed an amendment to the Finance (No. 2) Bill Keir Starmer Rachel Reeves Bridget Phillipson James Murray Abena Oppong-Asare Sir […]

27 November 2021, Advocates, Artists, Barristers, Charities, Companies, Creative Industries, Employer, General, Musicians, Sole Traders

What is a gift? This might seem to be an obvious question, but it helps to get the definition clear to work out the tax implication of gifts for customers and suppliers. A gift is something you give without receiving anything in exchange. For example, you may choose to give a customer a bottle of […]

21 November 2021, Charities, Companies, Creative Industries, Employer, General

It is tempting to have your company pay personal phone bills, but this article will alert you to some of the pitfalls. On the face of it you might think you save money on a cheaper personal contract. However after considering the VAT, income tax and National Insurance you might be better off on a […]

18 November 2021, Advocates, Artists, Barristers, Companies, Creative Industries, Employer, Musicians, Sole Traders

The budget confirmed a few increases to tax which are likely to stoke inflation in the form of the Health and Social Care Levy. The Finance Bill is currently passing through the legislative process to introduce tax increases for most people. How does the budget affect my business? The figure of 1.25% crops up in […]

9 May 2021, Advocates, Artists, Creative Industries, General, Musicians, Sole Traders

It is said that there are two certainties in life, death and taxes. The old cliche has a ring of truth, and you can add tax scams to the list of known knowns. Donald Rumsfeld was roundly mocked for his comment at a news briefing on 12th February 2002 about known knowns, but on reflection, […]

20 April 2021, Advocates, Barristers, Creative Industries, General, Musicians, Sole Traders

A sole trader may incur costs before setting up their trade. Some of these pre-trading expenses are allowable for tax purposes subject to being ‘wholly and exclusively’ for the trade or profession. Capital items purchased prior to trading may also qualify for capital allowances. Pre-trading expenses Expenses incurred up to 7 years before commencement of […]

25 April 2021, Advocates, Barristers, Creative Industries, General, Musicians, Sole Traders

Before you start to trade you can register for VAT as an intending trader to recover input VAT on computer equipment and other costs. You can also recover pre-registration VAT in some circumstances. Pre-trading VAT The current threshold for obligatory VAT registration is an annual turnover of £85,000. Voluntary registration is beneficial where: VAT on […]

23 February 2021, Advocates, Artists, Barristers, Charities, Companies, Creative Industries, Musicians, Sole Traders

A bolt from the blue – Receipt Bank is now Dext In a surprise announcement from Receipt Bank Dext, the branding and log in details for the online service changed today. How do I log in to Dext? If you previously used the following web address to log in to Receipt Bank, it should still […]

25 February 2021, Advocates, Barristers, Companies, Creative Industries, General, Sole Traders

Buying and selling services This article considers what has changed (and what hasn’t) for businesses trading in services with the EU, including situations where there are crucial exceptions to the general rules. The highlights of VAT on services outside the UK In many cases, the VAT on services is no different to pre-Brexit 2020. However, […]

27 January 2021, Artists, Charities, Companies, Creative Industries, Musicians, Sole Traders

Get up to £25,000 for Scottish Wedding Industry The new Scottish Wedding Industry Fund opens for applications on 28 January 2021. If your business gets most of its income from weddings you could qualify for a grant of up to £25,000. The fund is available to jewellers, pipers and wedding bands as well as caterers […]

25 January 2021, Advocates, Artists, Barristers, Creative Industries, Sole Traders

At (almost) the eleventh hour, HMRC announces tax filing deadline extended to 28 February HMRC announced today that you will not receive a penalty for filing your 2019-20 tax return late, as long as you file online by 28 February. We are still encouraging taxpayers who have not yet filed to do so by 31 […]

22 January 2021, Advocates, Artists, Barristers, Creative Industries, Sole Traders

Strapped for cash and worried about your tax? If you are one of the many self-employed who need extra time to pay your income tax bill at the end of the month, HMRC have an online process to help you spread your payment. With just over a week to go until the filing deadline for […]

10 February 2021, Advocates, Barristers, Companies, Creative Industries, General, Sole Traders

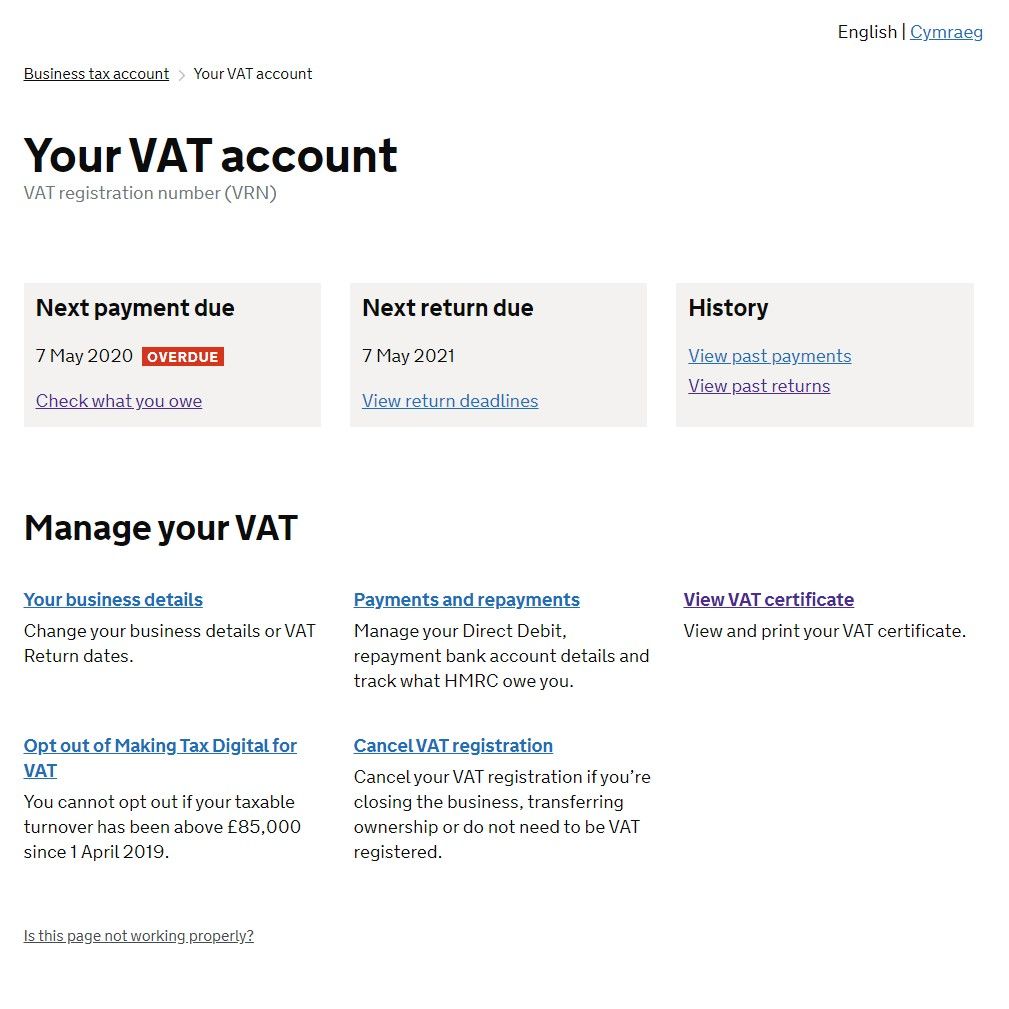

Deferred VAT payment due to Coronavirus On 24th September 2020 the UK Chancellor announced that businesses who deferred VAT due from 20 March to 30 June 2020 had more time to pay VAT from this period. The same guidance still stands though. If you chose to defer your VAT payment as a result of coronavirus, […]

30 December 2020, Advocates, Barristers, Companies, Creative Industries, General, Sole Traders

Action required by 8 April 2021 If you haven’t signed up for Making Tax Digital (MTD) yet, you need to change the way you submit your VAT returns. Even if you currently use Xero to file your VAT returns, you won’t be able to use software to file returns from 8th April unless you are […]

30 November 2020, Advocates, Artists, Barristers, Creative Industries, Musicians, Sole Traders

SEISS third grant open for claims. The rules on who is eligible to claim are different to those for the previous SEISS grants. The third grant will be based on 80% of three months’ average trading profits, paid out in a single taxable instalment capped at £7,500, and will cover the period from 1 November […]

5 November 2020, Advocates, Companies, Creative Industries, Employer, Sole Traders

When is the Bounce Back Loan Deadline? The Bounce Bank Loan deadline for applications was originally scheduled for 4th November 2020 and then extended slightly to 30th November 2020. The announcement by Rishi Sunak on 2nd November on the Bounce Back Loan extended deadlines for applications to 31st January 2021. The Bounce Back Loan Scheme […]

30 October 2020, Advocates, Artists, Creative Industries, Musicians, Sole Traders

Received an SEISS grant? Check your inbox to avoid a penalty. HMRC is contacting businesses which claimed a grant under the Self-Employment Income Support Scheme to check whether they have stopped trading. What do you need to do? How do I know an email from HMRC isn’t spam or phishing? HMRC do not normally email […]

1 November 2020, Companies, Creative Industries, Employer, General, Sole Traders

Coronavirus Job Retention Scheme Extended to end of March 2020 The furlough scheme, where the UK Government pays part of the salary costs of furloughed employees, was first extended to the end of November 2020. Then in an announcement on 5 November 2020 the scheme was extended further until the end of March 2021. Furlough […]

22 October 2020, Charities, Companies, Creative Industries, Employer, General, Sole Traders

What changed with the Job Support Scheme update? The Job Support Scheme update (JSS) announced by Rishi Sunak today (22nd October) reduces the costs for employers and also reduces the minimum hours for workers to 20% compared to 33% previously. The UK Government will issue further guidance shortly, but for the moment, here is what […]

6 November 2020, Advocates, Artists, Barristers, Creative Industries, Musicians, Sole Traders

Payment no 3 in December for SEISS extended to April. The Self-Employment Income Support Scheme (SEISS) has been extended to April 2021. If you are self-employed and were eligible for the first and second SEISS grants you will be able to claim grants for the 6 month period from November 2020 to April 2021. What […]

25 September 2020, Advocates, Barristers, Companies, Creative Industries, General, Sole Traders

Rishi Sunak has given you more time to pay VAT On 24th September 2020 the UK Chancellor announced that businesses who deferred VAT due from 20 March to 30 June 2020 will now have more time to pay VAT from this period. The original deadline for this VAT was 31st March 2021. Instead of paying […]

25 September 2020, Advocates, Companies, Creative Industries, Employer, Sole Traders

When is the Bounce Back Loan Deadline? The Bounce Bank Loan deadline for applications was originally scheduled for 4th November 2020. On 24th September Rishi Sunak announced that the deadline for applications would be extended to 30th November 2020. The Bounce Back Loan Scheme (BBLS) will help eligible small and medium-sized businesses affected by the […]

24 September 2020, Charities, Companies, Creative Industries, Employer, General, Sole Traders

How does the Job Support Scheme work? The Job Support Scheme is designed to protect viable jobs in businesses facing lower demand over the winter months due to Covid-19. Employers will receive support from the UK Government to help keep their employees on payroll after the furlough scheme is withdrawn. The company will continue to […]

14 September 2020, Advocates, Barristers, Companies, Creative Industries, General, Sole Traders

VAT is chargeable on all non-refundable deposits HMRC requires you to charge VAT on non-refundable deposits. So you must issue a VAT invoice for charges levied even if the customer does not use the goods or services. This came into force with effect from 1 March 2019, cancelling HMRC’s previous interpretation which allowed some non-refundable […]

14 September 2020, Advocates, Barristers, Companies, Creative Industries, General, Sole Traders

HMRC changes policy with VAT on Cancellation Fees On 2 September 2020, HMRC, issued a Brief dealing with the VAT on cancellation of a contract or early termination fees. The VAT treatment has changed for fees a business charges to allow customers to withdraw from agreements early. If your customer cancels an annual subscription part-way […]

Alterledger Ltd is registered with the Information Commissioners Office.

© 2024 Alterledger Ltd