How to set up a VAT Direct Debit

19 June 2020, Advocates, Barristers, Companies, Creative Industries, General, Sole Traders

Smarter accounting

19 June 2020, Advocates, Barristers, Companies, Creative Industries, General, Sole Traders

As part of the government’s support for businesses during COVID-19, HMRC gave businesses the option of deferring their VAT payments and cancelling VAT Direct Debit instructions if they were unable to pay on time. This allows VAT to be deferred without incurring late payment interest or penalties. Payment of VAT falling due between 20 March and 30 June 2020 can be deferred until 31 March 2021.

You must continue to file your VAT return on time, even if you deferred payment.

The option to defer paying VAT ends on 30 June 2020. This means that VAT returns with a payment due date after 30 June must be paid in full, on time.

If you haven’t deferred any VAT payments or still have a VAT Direct Debit, you don’t need to take any further action. If you have deferred paying your VAT and normally pay by Direct Debit you should now reinstate it.

You should do this at least three working days before submitting your VAT return in order for HMRC to take payment. For further details go to GOV.UK and search for ‘Pay your VAT bill’.

Please do not call HMRC for more information, everything you need to know is on GOV.UK. HMRC need to leave their phone lines open for those who need them most.

Remember, any VAT payments you have deferred during this period should be paid in full on or before 31 March 2021. You can make ad hoc payments or additional payments with your subsequent VAT returns to reduce the amount outstanding, if you wish.

If you’re unable to pay the VAT due and need additional time to pay, please contact HMRC before the payment is due. For help go to GOV.UK and search for ‘If you cannot pay your tax bill on time’, or call 0300 200 3835. If you do call, please quote ‘V1’.

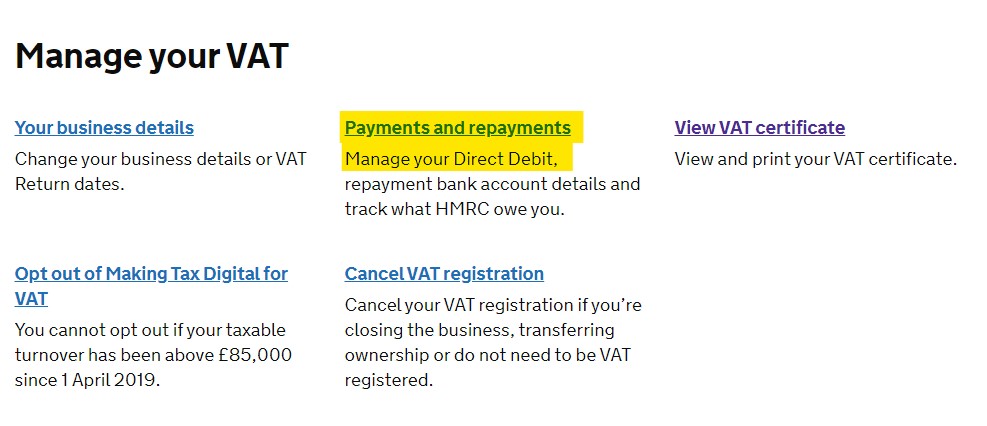

Log in to your HMRC online account and select your VAT account. From the VAT page you will be able to select the option Payments and repayments

Select the option to Set up a Direct Debit and on the next screen add your bank account details.

When the process is complete you will see a confirmation code. Print this page and keep it for reference

If you require more than one signatory to set up a Direct Debit, you will need to complete a paper form to set up your VAT Direct Debit.

Payments will appear on your bank statement as ‘HMRC E VAT DDS’

This Guarantee is offered by all banks and building societies that accept instructions to pay Direct Debits.

If there are any changes to the amount, date or frequency of your Direct Debit HMRC E VAT DDS will notify you 2 working days in advance of your account being debited or as otherwise agreed. If you request HMRC E VAT DDS to collect a payment, confirmation of the amount and date will be given to you at the time of the request.

If an error is made in the payment of your Direct Debit by HMRC E VAT DDS or your bank or building society, you are entitled to a full and immediate refund of the amount paid from your bank or building society.

If you receive a refund you are not entitled to, you must pay it back when HMRC E VAT DDS asks you to.

You can cancel a Direct Debit at any time by simply contacting your bank or building society. Written confirmation may be required. Please also notify HMRC.

HMRC will collect your payments automatically by Direct Debit.

If you have questions about your Direct Debit after you have set it up, call 0300 200 3700 and quote your VAT registration number.

Alterledger Ltd is registered with the Information Commissioners Office.

© 2024 Alterledger Ltd