Deferred VAT payment and how to cancel your Direct Debit

3 April 2020, Advocates, Barristers, Companies, Creative Industries, General, Sole Traders

Smarter accounting

3 April 2020, Advocates, Barristers, Companies, Creative Industries, General, Sole Traders

On 20th March 2020 the UK Chancellor announced support to businesses in the form of a deferred VAT payment scheme. This helps VAT registered businesses with their cash flow during the COVID-19 pandemic. All VAT registered businesses can defer VAT payments. If you currently pay by Direct Debit, you will need to know how to cancel your Direct Debit Instruction (DDI) to HMRC.

All businesses with a UK VAT registration have the option to defer VAT payments due between 20 March and 30 June. You have until 31 March 2021 to pay any VAT deferred as a result of this announcement.

If you wish to take advantage of a deferred VAT payment, you do not need to inform HMRC. You can opt in to the deferral simply by not making VAT payments due in this period. If you pay by Direct Debit you should cancel this with your bank or by logging in to your HMRC online account. You should do this in plenty of time so that HMRC does not attempt to automatically collect payment on receipt of your VAT return.

Should you wish, you can continue to make payments as normal during the deferral period. HMRC will also continue to pay repayment claims as normal. You must continue to submit VAT returns as normal.

If you leave your DDI in place, HMRC will collect any VAT due as reported in your next VAT return.

The process is different depending on whether you have registered for Making Tax Digital (MTD) for VAT or not. The steps below show how to cancel your Direct Debit if you are registered for MTD.

Log in at the following link: HMRC login

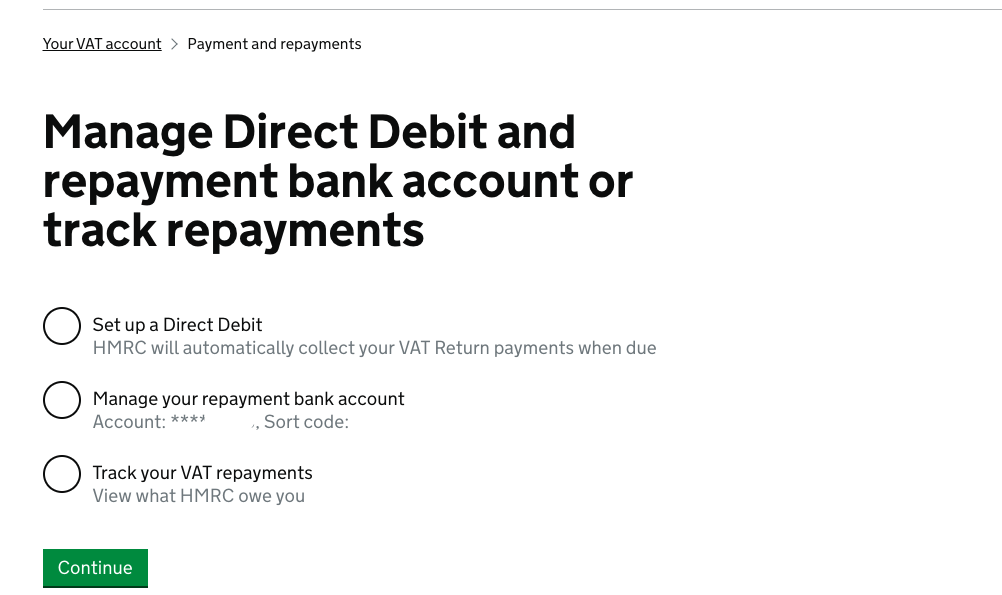

Select your VAT account from the home screen

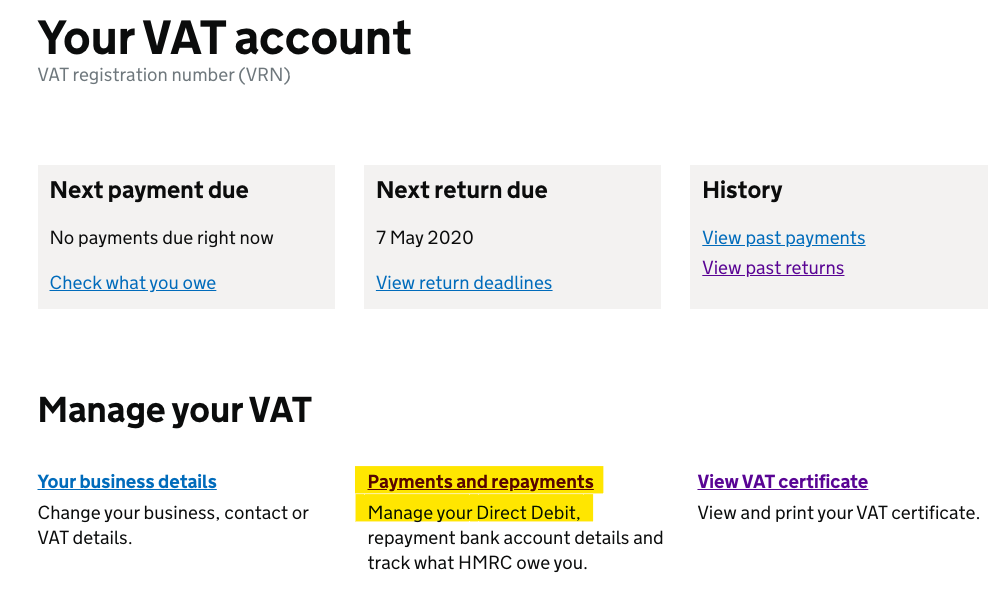

Select Payments and repayments from the VAT account screen

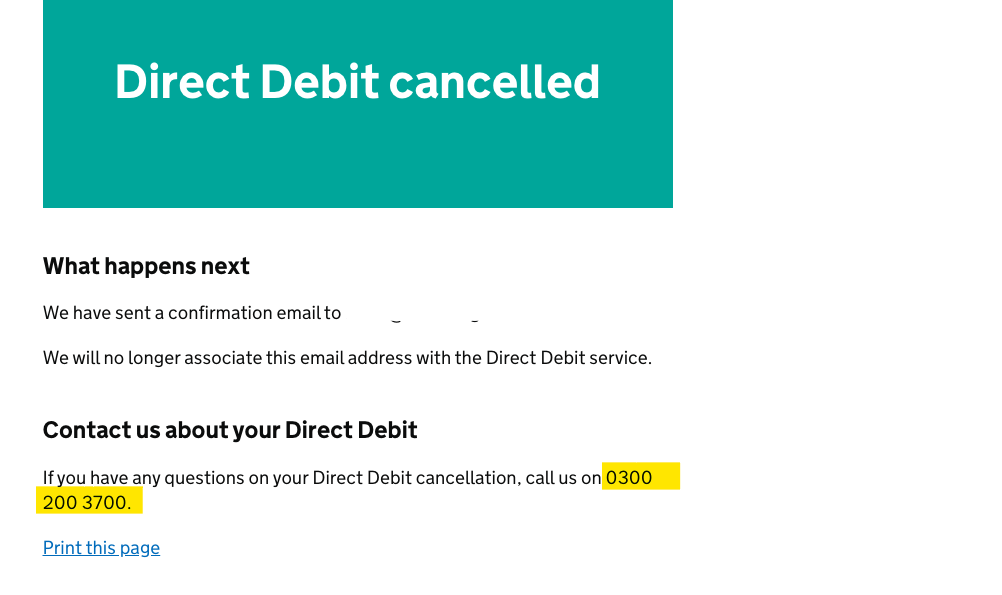

The following screen will confirm that your Direct Debit is cancelled

To set up a new Direct Debit Instruction follow the instructions above and select “Set up a Direct Debit”

If you are considering applying for a loan from the Coronavirus Business Interruption Loan Scheme (CBILS), the banks will expect you to access other sources of funding first. This includes making sure you have taken advantage of the deferred VAT payment scheme described above.

Alterledger Ltd is registered with the Information Commissioners Office.

© 2024 Alterledger Ltd