How to set up a manual VAT payment

10 February 2021, Advocates, Barristers, Companies, Creative Industries, General, Sole Traders

Smarter accounting

10 February 2021, Advocates, Barristers, Companies, Creative Industries, General, Sole Traders

On 24th September 2020 the UK Chancellor announced that businesses who deferred VAT due from 20 March to 30 June 2020 had more time to pay VAT from this period. The same guidance still stands though. If you chose to defer your VAT payment as a result of coronavirus, you should pay the VAT on or before 31 March 2021 if you are able to. The easiest way to do this if you have the case is to set up a manual VAT payment to HMRC.

Your deferred VAT from 2020 will not be collected automatically. Any VAT returns submitted since the deferred return still need to be paid in full. If you have a Direct Debit Instruction (DDI) in place for your VAT, the DDI will only collect the VAT on returns you submit after the VAT return was set up. HMRC will not collect the deferred VAT under your existing DDI.

Instead of paying the full amount by the end of March 2021, you can make smaller payments up to the end of March 2022, interest free. You will need to opt-in to the scheme, and for those who do, this means that your VAT liabilities due between 20 March and 30 June 2020 do not need to be paid in full until the end of March 2022. Details of the scheme have not been published by HMRC yet, but it will open on 23 February 2021. The scheme will close on 21 June 2021

Log in to your HMRC online account (Gateway account) and select View your VAT account.

If you deferred payment of your VAT due between 20th March and 30th June you should see an overdue notification and can click on the Check what you owe link to view the balance due.

If you want to start paying your VAT before 31st March 2021, the easiest way to do this is by bank transfer. Additional payments made before March 2021 will be applied to your overdue balance. Select Pay Now and then Bank transfer. You can pay by card, but there will be a fee for corporate cards. It is not worth getting into credit card debt for your VAT bill. If you can’t pay now, please consider using the VAT deferral new payment scheme when it opens on 23 February.

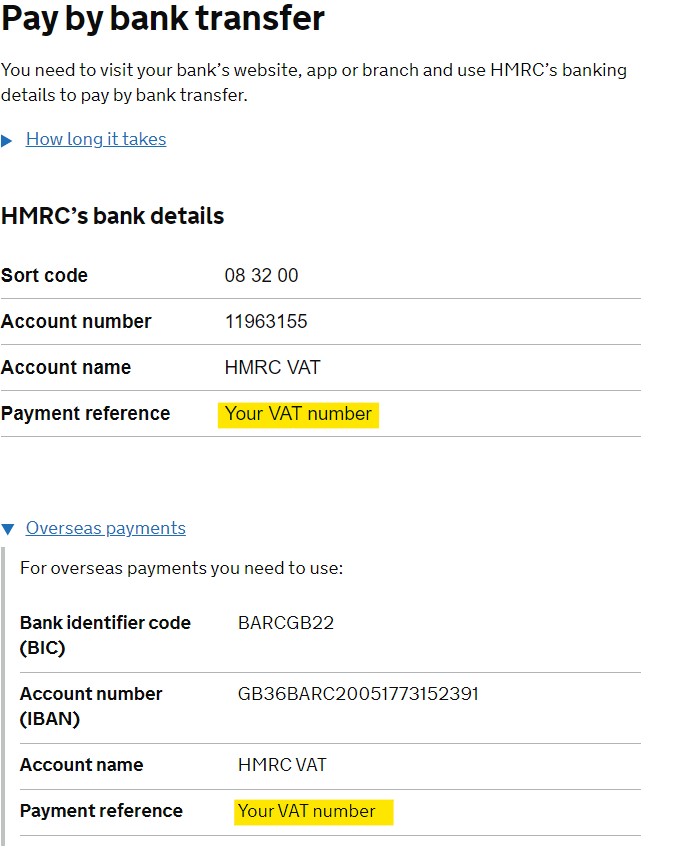

The bank details for your VAT payment are the same for all businesses. You need to include your VAT number as the reference so HMRC can match the payment to your account.

| Sort Code | 08 32 00 |

| Account Number | 11963155 |

| Account Name | HMRC VAT |

| Payment Reference | Your VAT Number (e.g. 123456789) |

If you are setting up the payment for the first time, your bank should verify the account details to give you the confidence that you are using the correct details.

Check the gov.uk website for details on opting in to the scheme for more time to pay VAT.

You cannot opt in yet. The online opt in process will be available between 23 February 2021 and 21 June 2021.

The VAT Deferral New Payment Scheme will require a Direct Debit to be set up as part of the digital opt-in process. This must be done by the authorised bank account holder. For this reason, you must opt in yourself, your agent cannot do this for you.

The new scheme lets you:

To use the online service, you must:

If you join the scheme, you can still have a Time to Pay arrangement for other HMRC debts and outstanding tax.

Instructions on setting up a Direct Debit Instruction to pay your VAT are here: http://bit.ly/Alterledger-how-to-set-up-DDI-for-VAT

Alterledger Ltd is registered with the Information Commissioners Office.

© 2024 Alterledger Ltd