Claim Newly Self-Employed Hardship Fund Grant of £2,000

30 April 2020

Grants for newly self-employed Applications for this grant opened on the afternoon of Thursday 30th April. Grants are administered by the local authority in which you live. To claim newly self-employed hardship fund cash, refer to your own local authority website. Claim Newly Self-Employed Hardship Fund Cash You need to apply in your Local Authority […]

Self-employment Income Support Scheme

27 March 2020

Government grant to freelancers Details of the Self-employment Income Support Scheme have now been released to support the self-employed or members of a partnership with trading income. Who can apply for the Self-employment Income Support Scheme? You can apply if you’re a self-employed individual or a member of a partnership and you: have submitted your […]

COVID-19 small business grants in Scotland

26 March 2020

Grants for business Each local authority will be processing COVID-19 small business grants in Scotland. Applications must be made to the local authority where you are liable for non-domestic rates. How to claim COVID-19 small business grants in Scotland There are two types of grant available to ratepayers: £10,000 grant to ratepayers of businesses in […]

Extend your accounts filing deadline

26 March 2020

Company Accounts If your company accounts can’t be prepared in time due to the COVID-19 emergency you can apply to extend your accounts filing deadline by 3 months. How to extend your accounts filing deadline Company accounts for a private limited company are normally due for filing 9 months after the year end date. If […]

Coronavirus Job Retention Scheme update

27 March 2020

Coronavirus Job Retention Scheme All UK employers will be able to access support for furloughed workers who would otherwise be laid off during the COVID-19 emergency. Details have now been released. An online portal will be made available to claim funding from the Coronavirus Job Retention Scheme, which will backdate funding to 1st March 2020. […]

No income tax payments due in July

20 March 2020

Payments on account cancelled in July The UK Government announced on 20th March that there would be no income tax payments due in July 2020 for the self-employed. Payments on Account Personal tax returns must be filed by 31st January following the end of the tax year. For the tax year ended 5th April 2019 […]

Alterledger and the Circular Economy

16 March 2020

Defining the Circular Economy The circular economy is a viable alternative to former unsustainable ways of operating. Accountants are joining other businesses and the City of Glasgow in recognising the positive impact of changing working practices to create a more sustainable future. The circular economy is a direct challenge to the ‘take-make-waste’ mentality of the […]

Newly Self-Employed Hardship Fund

24 April 2020

Grants for newly self-employed The Scottish Government has announced a £34 million Newly Self-Employed Hardship Fund. The fund will be managed by Local Authorities to allocate grants of £2,000 to the newly self-employed facing hardship. The self-employed who started trading after 5th April 2019 are excluded from the Self-Employment Income Support Scheme. The Scottish Government […]

Company Van Benefit in Kind trap

26 January 2020

Van benefit in kind tax charge Driving a van as your company vehicle has tax advantages over a car. The tax charge is generally low compared with a car, and can even be zero in circumstances where a car would be taxable. What conditions must you satisfy to eliminate a van benefit in kind tax […]

VAT Expenses – What proof does HMRC need?

24 January 2020

A recent case of missing documents highlights the need for supporting information for VAT expenses to minimise your VAT bill to HMRC. Make sure you have good bookkeeping systems to get the VAT back that you are entitled to.

Alterledger in Tramshed Tech

13 December 2019

Alterledger is coming to Tramshed Tech in Cardiff to give free tax and accounting advice at 11:00 on 20th December Alterledger has been on tour with sessions for the creative industries in Glasgow on 10th December 2019 and Belfast on 12th December 2019. It will be Cardiff’s turn on 20th December so Tim Alter will be in […]

Tax and Accounting for Musicians: Get It Right and Save Money!

5 December 2019

Free Tax and Accounting for Musicians’ Union members Members of the Musicians Union are invited to a free seminar – Tax and Accounting for Musicians in Glasgow on 10th December 2019 and Belfast on 12th December 2019. You can learn how to take some of the stress out of filing your tax return. If you are […]

Give gifts on 5th December

3 December 2019

You can give gifts to your staff and customers at any time of the year. Learn how to avoid the pitfalls of paying tax and VAT on your generosity.

Tax charge on a Director’s Loan

20 September 2019

When your company has a tax charge on a director’s loan If you are a director or shareholder in a ‘close’ company, any money owed to the company can trigger a tax charge on a director’s loan. What is a close company? A close company is broadly defined as a company which is under the […]

Love what we do? Tell a friend and get £100 each for you and them

10 June 2019

Get £100 each for you and a friend If you are a client of Alterledger, you can get up to £100 for yourself and for any friends that you refer to us. How do I get my reward? We’ll add credit to your account after your friend becomes a paying customer of Alterledger. What if […]

MTD Registration – progress to date

19 August 2019

MTD Registration – Key numbers The Making Tax Digital (MTD) rules became law for VAT periods starting on or after 1 April 2019. MTD registration requires VAT-registered businesses with taxable turnover over £85,000 to keep their VAT records digitally. They must also submit their VAT return direct from their Making Tax Digital-compatible software. The MTD […]

Pension re-declaration of compliance

13 May 2019

How to complete your auto-enrolment pension re-declaration of compliance Any employers who started employing workers before 1st October 2017 will have been issued with a staging date. This is the date when they had to have a qualifying auto enrolment pension in place. For anyone who starting employing people after 30th September 2017 pension duties […]

Pension re-enrolment

8 May 2019

Pension Re-Enrolment due every three years All employers should now be aware of the their pension obligations. Any employers who started employing workers before 1st October 2017 will have been issued with a staging date. This is the date when they had to have a qualifying auto enrolment pension in place. For new businesses / […]

Monthly PAYE payments or quarterly payments?

15 May 2019

How to pay your PAYE to HMRC The easiest way to pay your PAYE to HMRC is by bank transfer. The bank details for HMRC are shown below. You’ll need to use your 13-character accounts office reference number as the payment reference. You can find this on either: the letter HMRC sent you when you first registered […]

Furloughed workers

23 March 2020

Furloughed workers and the Coronavirus Job Retention Scheme All UK employers will be able to access support for furloughed workers who would otherwise be laid off during the COVID-19 emergency. Details have now been provided by the UK Government. An online portal will be made available to claim funding from the Coronavirus Job Retention Scheme, […]

How many VAT registered businesses in the UK need to sign up to Making Tax Digital

30 March 2019

How many VAT registered businesses in the UK are there? Figures from the Office of National Statistics state that there are 2.67 million businesses registered for VAT and/or PAYE. Any business with employees must register for PAYE, but not all of these businesses are registered for VAT. This prompts the question – how many VAT […]

How late can I register for Making Tax Digital for VAT?

29 April 2019

When is my first Making Tax Digital VAT return due? If you are asking yourself “How late can I register for Making Tax Digital for VAT? (MTDfV)” you are likely to be storing up problems. Suppose you submit quarterly VAT returns to June and have to register for Making Tax Digital for VAT (MTDfV); your […]

Alterledger customer reviews are now on Trustpilot

5 June 2019

Trustpilot Alterledger customer reviews are now on Trustpilot. We previously used vouchedfor, but on the 4th June we started a review page on the Trustpilot site. If you have benefited from Alterledger’s services, why not leave a review? Trustpilot Why change to Trustpilot? The vouchedfor website is specifically for accountants and other financial services, but […]

Has Making Tax Digital for VAT been delayed?

15 March 2019

Has Making Tax Digital for VAT been delayed? Making tax digital for VAT legislation requires you to have “digital links” between your financial data and your VAT reports to HMRC. What changes might you need to make to your record keeping to achieve this? A “soft landing” delays the date that you need to have […]

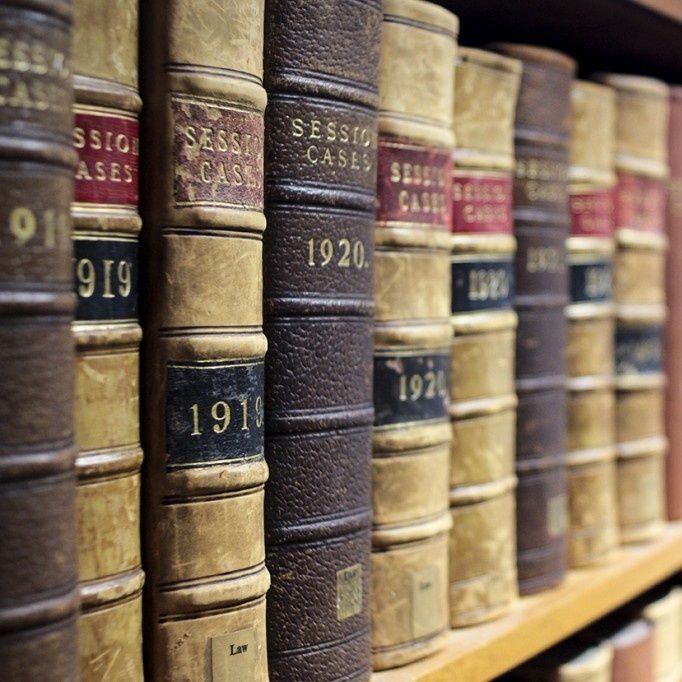

Advocates Making Tax Digital for VAT Questions and Answers

2 March 2019

Advocates Making Tax Digital for VAT Questions and Answers Tim Alter gave a lunchtime talk to the Scottish Bar on 1st March 2019. The members of the Faculty of Advocates were highly engaged in the session on Making Tax Digital for VAT. There was a lively and heartfelt response including a wide ranging discussion on […]

Advocates Making Tax Digital for VAT seminar in Edinburgh

28 February 2019

Advocates Making Tax Digital for VAT seminar We are looking forward to presenting the Advocates Making Tax Digital for VAT seminar in the Mackenzie Building in Edinburgh on 1st March 2019. Tim Alter will be presenting the lunchtime talk to the Faculty of Advocates. For any advocates who can’t make the Edinburgh talk at 1:00 […]

Childcare voucher scheme – closure delayed again!

9 May 2018

Scheme open to new entrants until 4 October 2018 Childcare voucher schemes were supposed to close to new applicants on 5 April 2018, but has been extended for a further six months. Should you consider offering childcare vouchers to your employees while you still can? Summary of childcare voucher scheme The childcare voucher schemes were supposed to […]

Making Tax Digital for VAT – why have HMRC sent a letter?

22 November 2018

HMRC VAT letter – what does it mean? Many business have received an HMRC VAT letter in the last week. This letter informs VAT registered businesses that HMRC processes are being modernised, known as Making Tax Digital (MTD) for VAT. What do I need to do? The HMRC VAT letter doesn’t require you to do anything […]

How to reclaim extra VAT

2 December 2017

HMRC’s VAT Input Tax Toolkit highlights common errors businesses make when they reclaim VAT on purchases. As you would expect from an HMRC publication it focuses on situations where you can’t or shouldn’t reclaim VAT.

Accounting for Musicians Workshop Belfast @OhYeahCentre 2017

26 November 2017

Members of the Musicians Union are invited to a free seminar in Belfast on 7th December 2017. See below for booking form on Eventbrite.